Can You Lose Your Home Due to Medical Bills

In a Nutshell

If you're struggling to make ends run across while dealing with medical bills, bankruptcy tin can provide relief. Medical debt and loss of income for medical reasons plays a role in more than 60% of personal bankruptcy filings.

Medical bills are almost always unexpected. 39% of Americans don't have the dispensable income to pay for an unplanned emergency costing more than $400. Fifty-fifty when we're non living through a pandemic, medical bills tin pile upwardly fast. If you're drowning in medical debt, you may be request if you can go rid of your medical bills by filing bankruptcy. We have skilful news...

You Can Eliminate Medical Debt Through Bankruptcy

Medical debt incurred before y'all file bankruptcy is eliminated when you receive your bankruptcy discharge.

That fifty-fifty includes any medical bills you don't get until after the bankruptcy case is filed. As long as the medical treatment happened before filing, the debt is dischargeable.

What Type of Debt Is Medical Debt?

In a bankruptcy case, all of your debts are put in 1 of three categories:

-

Secured debt: The type of debt is backed by property. The nearly common secured debts are car loans.

-

Unsecured debt: This type of debt is not continued to a specific piece of property. Unsecured debt includes credit card debt, personal loans, educatee loans, etc.

-

Priority debt: Unsecured debt that gets special (priority) treatment under the Bankruptcy Code. Examples include tax debts, child support, and alimony.

Medical debt is unsecured debt.

Tin you lose your home due to medical bills?

Because medical bills are an unsecured debt, they're not connected to any property at all. If payments aren't made on a medical debt, all an unsecured creditor like a infirmary can exercise is file a lawsuit. Typically, unsecured creditors collect on their judgment by doing a wage garnishment. But the judgment could attach to your real estate. It depends on state law whether a judgment can lead to a foreclosure.

What's more common are foreclosures by mortgage companies afterward health problems cause someone to fall behind on their mortgage payments.

How many bankruptcies are due to medical bills?

This is a difficult question to reply because there are dissimilar ways medical bills can lead a person to file bankruptcy:

-

cases where hospital bills make upwards near of the debt

-

cases where the cost of medical care and lack of insurance coverage caused the filer to employ credit cards to pay for other expenses

-

cases where the filer used credit cards to pay for medical expenses not covered by their health insurance

In 2005, then-Harvard professor Elizabeth Warren published a paper concluding that more than 40% of personal bankruptcies are due to medical debt. This number was updated to more 60% in 2009.[ 1 ]

Not all researchers agree with this number.

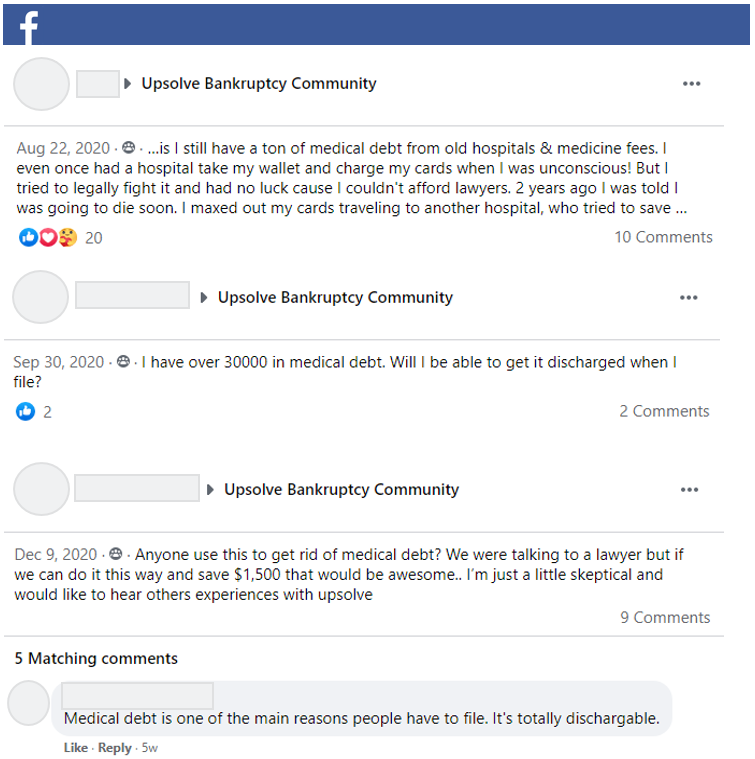

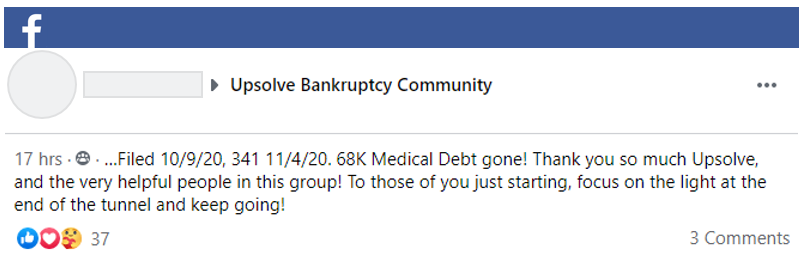

From experience, nosotros can tell yous that almost all low-income Americans who file bankruptcy have some sort of medical debt. Here'southward but a small sampling on questions related to medical debts from our Facebook Customs.

When should I file defalcation for medical bills?

That'southward another difficult question. Filing defalcation is not right for everyone or every situation. Some factors to consider are:

-

The amount of medical debt: Can you pay it off in a twelvemonth with monthly payments?

-

Your total debt: Are you juggling multiple debt repayments every calendar month?

-

The amount of coin you lot earn: What blazon of bankruptcy can you file?

-

The exemptions you can claim to protect your belongings: Would you lose whatever property past filing bankruptcy?

A free credit counseling session tin can assist you effigy out whether defalcation is the best debt relief selection for yous.

What happens to my other debts in a medical bankruptcy?

Bankruptcy law requires that all of your debt is listed in your defalcation forms. That'due south why there's no such affair every bit a true "medical bankruptcy." Creditors are treated differently depending on the type of debt y'all owe and the type of bankruptcy you file.

What are the Types of Bankruptcy?

Most people file Chapter vii or Affiliate 13 bankruptcy. Each type of bankruptcy takes into account the filer's healthcare costs.

Affiliate 7 defalcation

This is the most mutual type of bankruptcy. source Information technology'southward sometimes called a "liquidation bankruptcy" the filer agrees to give up certain unprotected property in exchange for a fresh start. About people who file Affiliate vii bankruptcy are able to keep all of their belongings using defalcation exemptions.

Since Chapter 7 is only available to people who don't make too much money and laissez passer the ways test, there's no repayment programme. Instead, the bankruptcy belch wipes out nigh debt in as petty as three - 4 months.

Chapter 13 bankruptcy

Chapter thirteen does involve a repayment plan and is often used to take hold of up on real manor loans and prevent a foreclosure. Filers brand payments - based on their monthly income and expenses - in commutation for protection from creditors. Once the payment plan has been completed, the bankruptcy discharge wipes out all remaining debts.

Which blazon of personal bankruptcy is best for your situation depends on... well… your situation. To learn more, consider scheduling a gratis consultation with a bankruptcy attorney in your surface area.

Does Filing Bankruptcy Hurt My Credit

Yes and no. It all depends on your state of affairs.

I'thousand current on everything and take great credit!

Filing defalcation volition hurt your credit and credit score. The question y'all take to ask yourself is whether you lot can set up an affordable repayment plan for your medical debt. If not, y'all take a chance falling behind on other debts which besides hurts your credit rating.

I have a hard time making ends come across every month.

If you lot've been living paycheck to paycheck before y'all had the medical debt, protecting your credit is about to become incommunicable. Filing Chapter 7 bankruptcy can bound start your financial recovery by giving you a clean slate, even if yous still have ok credit.

Especially if the amount of medical debt is much higher than your total debt, your credit report volition endure no thing what. While medical providers may not be as quick to submit information for your credit report, eventually they will. If yous're unable to pay your medical bills, this means they'll starting time impacting your credit score sooner or later.

A bankruptcy will give you the chance to first rebuilding your credit rating.

Let's Summarize…

You tin can get rid of medical bills in Chapter 7 and Chapter 13 defalcation. What type of bankruptcy is right for you (if any) depends on your financial state of affairs equally a whole. So, go along doing what you're already doing and enquiry your options.

If you're worried about filing bankruptcy without professional assist, schedule a free consultation with a local bankruptcy lawyer to become legal advice. If you tin't afford to hire a lawyer, you may be able to use Upsolve'due south complimentary web tool to file bankruptcy.

Either way, remember, you're non solitary and yous can get through this.

If you're struggling with medical bills check out this resource folio from our friends at Triage Cancer. Even though their mission is specific to folks dealing with a cancer diagnosis, their content includes information that's helpful for anyone overwhelmed with medical expense.

Sources:

- American Periodical of Public Health. ( 2020, March ). Medical Defalcation: Yet Common Despite the Affordable Care Act. 109, no. iii . Retrieved Oct 1, 2020, from https://ajph.aphapublications.org/doi/10.2105/AJPH.2018.304901

Source: https://upsolve.org/learn/get-rid-of-medical-bills-in-bankruptcy/

0 Response to "Can You Lose Your Home Due to Medical Bills"

Post a Comment